The posts follow a larger conversation in Canada about an affordability crunch often blamed on high rents and grocery prices and concerns about population growth, sometimes attributed to immigration rates.

One of the posts referenced coverage of an April 2024 paper (archived here) by the McGill Institute for the Study of Canada. It cited data estimating onward migration of naturalized Canadians between 2017 and 2019 was 31 percent higher than the average rate — with the trend attributed to the high cost of living and lack of opportunity for foreign degree holders.

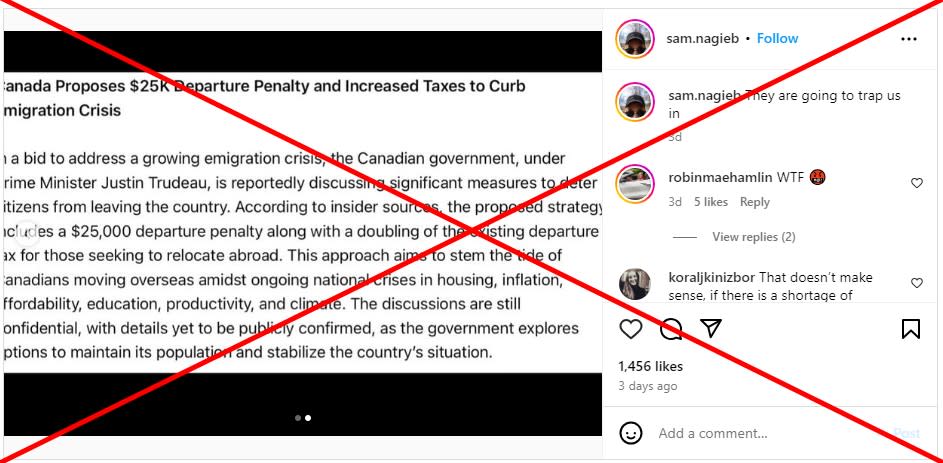

Online discussions of economic pressures have also sparked misinformation fact-checked by AFP and this claim about departure penalties is similarly incorrect.

“Any allegation that the Government of Canada is imposing a fine on Canadians seeking to leave Canada is false,” a Department of Finance official said in a May 7 email.

Many of the posts reference “The Executive Dish” as the source of the claim, but AFP was not able to find evidence of any such media company or personality online (archived here).

Additionally, a keyword search does not yield any results supporting the claim from before the posts’ appearance (archived here).

Taxing emigrants

Some posts referenced a page on a Government of Canada website describing a “departure tax” (archived here). This is an existing tax, levied by Canada’s Revenue Agency (CRA) on particular assets owned when one severs residential ties with Canada.

The CRA website says property is deemed disposed-of at fair market value when a person leaves Canada and immediately reacquired for the same amount.

If the fair market value is higher than the adjusted cost basis, this may create a tax liability on the capital gain. This is what is commonly referred to as a “departure tax,” according to the CRA and Scotia Bank (archived here).

The budget introduced by the Liberal government includes a higher tax rate for capital gains in excess of CAN$250,00 (approximately USD$182,000) on some assets — affecting a small number of taxpayers — and also raised rates for businesses and trusts.

Taylor Cao, a tax associate based in Toronto with Osler, Hoskin & Harcourt (archive here), explained the capital gains changes proposed in Canada’s 2024 budget meant people leaving the country who have accrued gains on certain types of assets above that threshold could be subject to a higher departure tax when emigrating. But he said this change did not include a flat $25,000 fine as claimed in the misleading posts.

“I am not aware of a penalty like that,” Cao said.

Read more of AFP’s reporting on misinformation in Canada here.