The proposal would tax income at rates of 5.55% in the top bracket and 5.15% in the bottom bracket. For individuals, $23,000 a year in taxable income marks the dividing line between the two rates; $46,000 for married couples filing jointly.

The Senate passed the bill 24-9 just before 1 a.m. The House followed, sending the legislation to Kelly in a 119-0 vote at about 2:30 a.m.. The measure was the last bill the Legislature approved before beginning a weeks-long break. Lawmakers will return to Topeka on April 25.

“This plan is a compromise. It’s fair. And it’s time,” Senate President Ty Masterson, an Andover Republican, said.

The swift passage came a day after a tax compromise supported by the Senate ran into opposition in the House. The compromise, which maintained the three-bracket tax system, had Kelly’s approval.

But Kelly may be hesitant to sign the new deal. The Democratic governor didn’t immediately comment on the legislation, but her chief of staff, Will Lawrence, shared with reporters concerns about the size of the package. Senate Minority Leader Dinah Sykes, a Lenexa Democrat, suggested the governor won’t approve it.

The measure is expected to cost roughly $635 million in revenue in the first year, and roughly $460 million each year after. During tax negotiations, Kelly has generally wanted to limit annual costs to about $425 million.

“I see a future where this is probably going to get vetoed,” Sykes said.

Both Kelly and Republican leaders have made tax relief a key priority of the legislative session. While Kelly is a little more than a year into her second term, every legislative seat will be on the ballot this fall and Republicans are attempting to maintain their supermajorities in both the House and Senate.

Under current Kansas law, the tax brackets are set at 3.1%, 5.25% and 5.7%, with individuals making over $30,000 a year in taxable income taxed at the top rate. Lawmakers stressed that even though the bottom rate is being eliminated, every taxpayer should either pay the same or pay less.

The bill raises the personal exemption allowance amount from $2,250 all taxpayers to $18,320 for married couples filing jointly and $9,160 for everyone else. Each dependent would lead to an additional $2,320.

The measure also eliminates taxes on Social Security income, lowers the statewide mill levy for schools from 20 mills to 19.5 mils and accelerates the elimination of the state sales tax on food to July 1, six months ahead of current law.

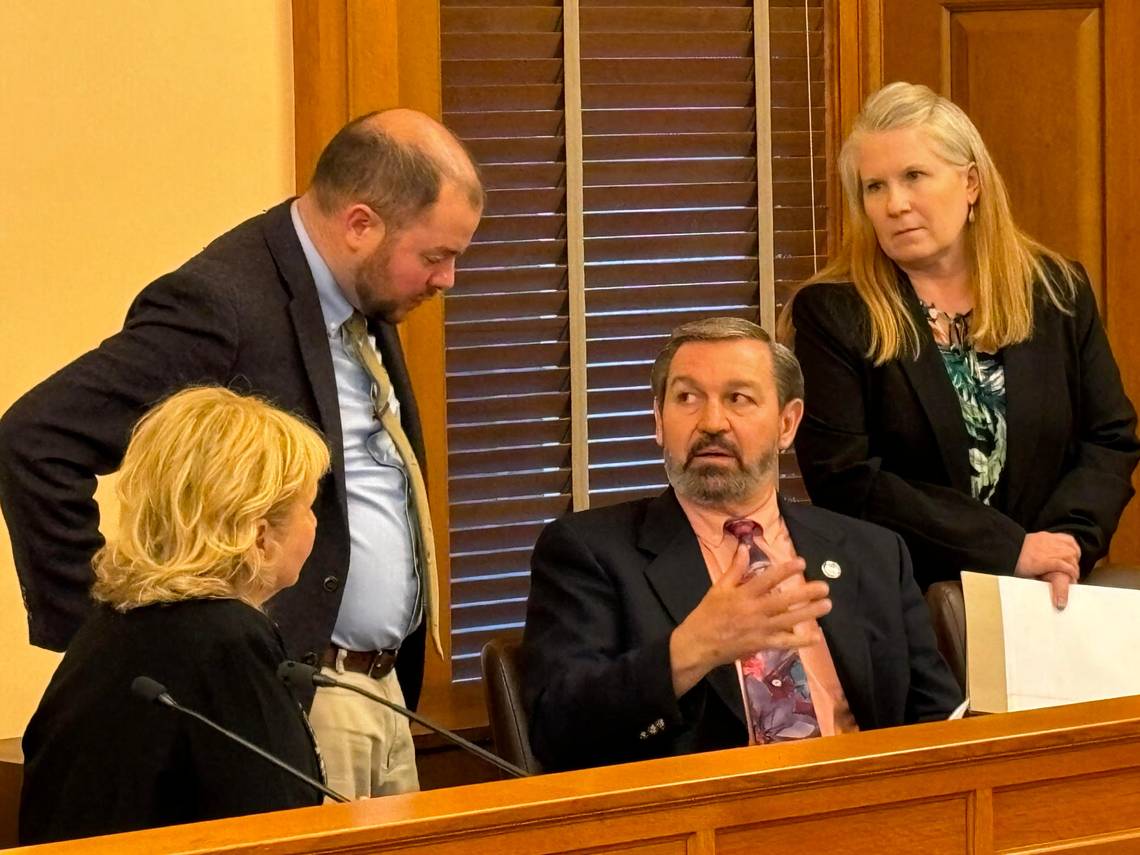

“I think we’re looking at really good policy here,” Sen. Caryn Tyson, a Parker Republican and chair of the Senate Tax Committee, said of the deal.

Kelly has threatened to call lawmakers into special session if they adjourn for the year without passing tax relief she finds acceptable. But she has also emphasized that tax cuts should be sustainable and has repeatedly invoked Republican Gov. Sam Brownback’s signature income tax cuts – and the budget crisis that followed – as an example to avoid.

“The governor has been clear on her concern about the fiscal sustainability of these plans,” Lawrence said.

Sen. Rob Olson, an Olathe Republican, condemned the plan in a fiery floor speech. He compared the legislation to the Brownback tax cuts and warned lawmakers were leading Kansas down a similar path.

“I was here when the Brownback tax cut passed and I heard the same kind of things, how good it was going to be for Kansas. It was a disaster,” Olson said.

Until Friday, lawmakers had struggled to find common ground on taxes. A single-rate income tax bill passed the Legislature earlier this year, largely with Republican support, but was vetoed by Kelly. Supporters were unable to override the veto.

The House later unanimously passed its own tax package, which like Friday’s proposal also included two rates. But it ran into Senate opposition. Then on Thursday night, the House rejected a tax compromise that enjoyed the support of Kelly and the Senate.

“We both fired a shot across the bow,” said Rep. Adam Smith, a Weskan Republican who chairs the House Tax Committee. “We kind of established our positions and, I think, this is actually a pretty good compromise.”