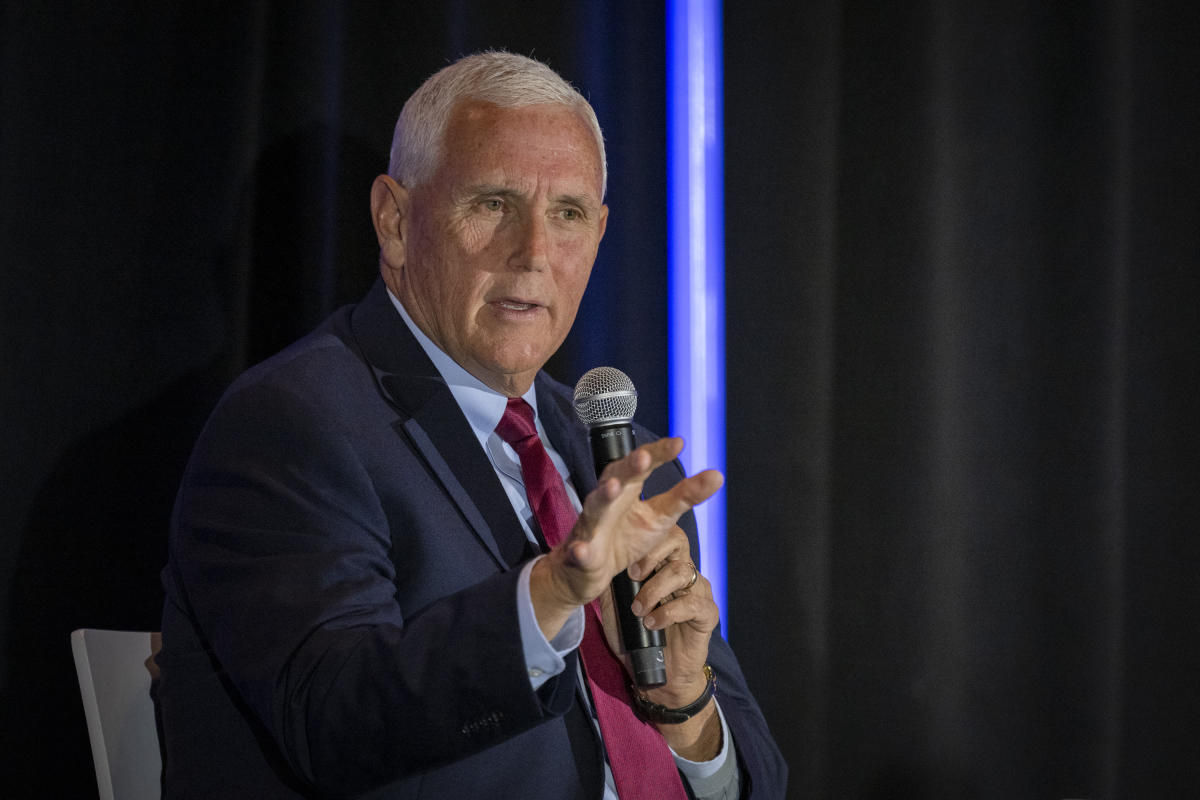

WASHINGTON (AP) — Previous Vice President Mike Pence’s structure is releasing a $10 million project to maintain the Trump-era tax cuts that are set to end after next year as he presses conservatives not to wander off from the battle before the November election.

Advancing American Liberty launched a 13-page plan Thursday with arguments being made to Capitol Hill and to citizens in swing states, especially in those that might choose control of the Senate.

“We will be prompting conservative leaders to join us in this battle,” according to the file.

The group pictures a prolonged project that will spin into 2025 when the White Home and Congress will need to choose whether to keep the tax code as authorized in the 2017 tax law when Republican politician Donald Trump was president or make modifications. If absolutely nothing is done, much of the private tax policies would end after 2025.

Much will depend upon power centers in your home and Senate and which celebration manages the White Home.

Democratic President Joe Biden has actually proposed keeping the tax cuts for individuals making under $400,000 a year while raising the business rate and presenting greater taxes on the rich. Trump, the presumptive Republican candidate for the White Home, likewise wishes to keep the tax cuts for lots of families, however he proposes reducing the business tax rate to 20%, from the existing 21% rate.

“Washington has a costs issue, not an earnings issue,” Pence stated in a declaration. “Our nationwide financial obligation runs out control, and taxing the American individuals more is not the option.”

Previous Sen. Pat Toomey of Pennsylvania, a Republican politician who contributed in crafting the 2017 tax expense, is a strong fan of the structure’s project to extend the tax policies.

The push comes as Congress has actually silently started workshopping tax policy before next year’s session, when legislators need to attend to the concern or danger enabling a few of the 2017 policies to end, possibly raising taxes for lots of people.

The federal balance sheet remains in the red, the nonpartisan Congressional Spending plan Workplace stated today, with costs outmatching profits. That remains in big part since of the COVID-era expenses, moneying for the war in Ukraine and the expenses of Medicare, Medicaid and other programs especially to take care of an aging U.S. population.

A CBO report in Might approximated that extending the arrangements of Trump’s Tax Cuts and Jobs Act would increase deficits by almost $5 trillion into 2034.