The Sedgwick County Commission will consider vetoing Goddard’s plan to give a developer $3.5 million in state incentives to build apartments at the Genesis Sports Complex, documents show.

The commission’s May 8 agenda was published Friday afternoon, several hours after a Wichita Eagle report found $1.2 million of the incentive package would be used to fund a land transfer from an LLC owned by Rodney Steven II and Brandon Steven to an affiliated LLC with unknown ownership and unclear ties to Rodney Steven II.

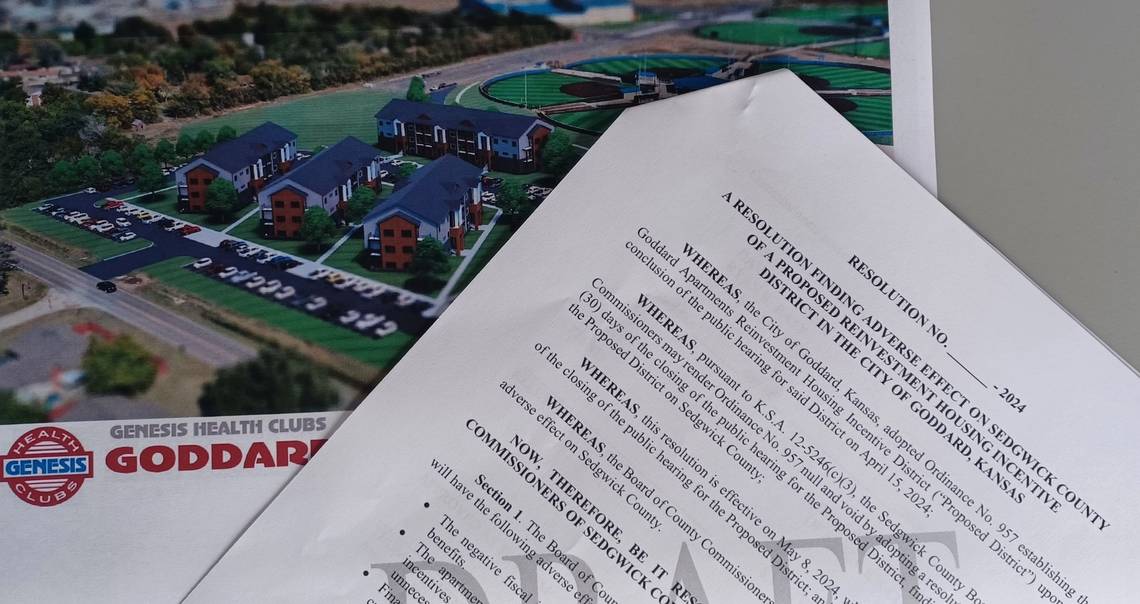

The land would be the site for 100 garden-style apartments near baseball and softball diamonds at the Genesis Sports Complex south of Kellogg in Goddard. It would be the second time Goddard has used state incentives to buy the 7.57 acre site for a developer.

Three commissioners, the number needed to reject the incentives, have signaled their opposition to the Goddard’s plan: Republicans Jim Howell and David Dennis, whose district includes Goddard, and Democrat Sarah Lopez. Republicans Ryan Baty and Pete Meitzner said they were still researching the project Friday afternoon.

“My job is to protect all taxpayers in the county, not just special interests of a few,” Lopez said in a statement. “Goddard could benefit from those housing units, but not on the backs of everyone else.”

Wichita suburb wants to use new state incentives for land deal involving Steven brothers

Sedgwick County staff prepared a draft resolution outlining three “adverse effects” that would be grounds for nullifying the city of Goddard’s incentive agreement: negative fiscal impact on the county, unnecessary costs for taxpayers and a risk of wasted taxpayer funds. The commission can adopt the resolution to block the deal or take no action, allowing it to pass by default.

The Wichita suburb already approved a $2 million federal housing grant and $17.35 million in industrial revenue bonds – which eliminates sales tax on construction materials – to subsidize the apartment project.

Goddard’s city administrator said the apartment project cannot be completed “but for” an additional $3.5 million in Reinvestment Housing Incentive District funds, which the Goddard City Council approved unanimously at its April 15 meeting.

Similar to tax increment financing — or TIF — RHIDs divert local property taxes within the district to reimburse developers for eligible costs such as land acquisition and public improvements. RHIDs can last up to 25 years — five years longer than TIF districts — meaning properties in reinvestment housing districts this year would not return to the tax rolls until 2049.

Any local taxing jurisdiction in the district may nullify an RHID project within 30 days or the incentives automatically take effect. In Goddard, that includes the Sedgwick County commission and the Goddard school district.

The RHID incentive program had been confined to rural areas but was recently expanded by the Kansas Legislature to allow its use in urban and suburban housing projects. Much of Wichita and its suburbs are now eligible for the housing incentive.

The Goddard apartment project is the first RHID project approved by a local government in Sedgwick County.

The county or school board can veto any RHID project that commissioners determine would have “adverse effects” on it. Commissioners have previously cited concerns that RHIDs in Sedgwick County could create an unfair playing field that rewards developers while placing the property tax burden on everyone else.

“It’s apparent we have a housing shortage in Sedgwick County,” Baty, commission chairman, said in a statement to The Eagle. “Any incentive tool, such as RHID, should only be used if the market can’t meet the need without its use. I do think there is room for this program with a very narrow scope of affordable housing and urban infill development. I’m still evaluating the Goddard project and working to find some answers to several concerns.”

The agenda’s staff report and a draft resolution outline three reasons the commission could nullify Goddard’s incentives agreement.

▪ “The negative fiscal impacts of the Proposed District on Sedgwick County exceed the benefits.”

▪ “The apartment complex in the Proposed District is economically feasible without incentives, thus the Proposed District creates additional cost for the county’s taxpayers unnecessarily.”

▪ “Financial guarantees by the developer are insufficient to mitigate against default risk, thus creating a risk that county taxpayer dollars will be spent on a project with increased risk of default and wasted taxpayer funds.”